Another name of preference share is known as preferred stock. These are the shares that are denoted to the company's stock on which the dividend is to be given to the shareholders prior to the allotment of the common stock dividends. But once the business gets bankrupt then Preferred Shareholders are liable to be paid prior to the ordinary shareholders from the fixed or variable assets of the organization.

The majority of the preferred shares have fixed dividends while the common stocks do not have. Also, the preferred shareholders do not have the right to vote. While the ordinary shareholders do have. Preference Shares lie beneath the 4 sections participating preferred stock, cumulative preferred stock, non-cumulative preferred stock, and convertible preferred stock.

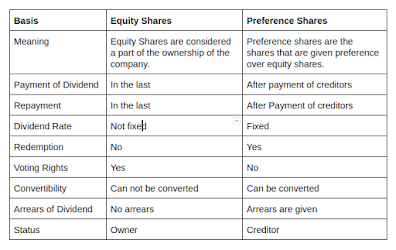

Read Also:- The Difference Between Equity Shares and Preference Shares of a Company

A cumulative preferred stock consists of the procurement which proposes the company to pay all the dividends to their shareholders, it constitutes those who were not present before when the dividends can be taken from common shareholders. The type of payments can be given but it can not always be furnished when it is not filed.

Read Also:- What All You Must Know About The Allotment of Preference Shares?

Understanding Preference Shares

The dividends in installments are given to unpaid dividends and should legally move with the owner of stock during the furnishing of payment. The owner of this preferred stock shall be given an additional consideration that is interest.

The non-cumulative preferred stock will not deliver missing or delayed dividends. If the company assumes not to give any dividends in the particular year then the non-cumulative preferred stock owner will not have the right or power to avail that overlooked dividend in the future times.

Read Also:- Key Difference Between Allotment of Shares And Issue of Preference Shares

The owners have the power to take the dividends relevant to the commonly recognized rate which they opted but this can be claimed when people own the preferred stocks also they shall be given an added dividend dependent on a predefined situation.

There is an option by which the preferred shareholder can convert their preferred shares into the number of ordinary shares, commonly at any time post to pre-establishment date. In the regular events at owners please, the convertible preferred shares are reciprocated.

The preference shares are said to be corporate shares with the dividends issued to the shareholders prior to paying the dividends to the common shares. There are 4 classified preferred stocks such as non-cumulative, convertible, participating, cumulative(guaranteed).

For cautious investors, preferential shares are ideal the issuer can purchase those ones at any time.